While there is merit in questioning whether you’re getting value for money when dealing with Sectional Title levies, the old adage of “Goedkoop is duurkoop” certainly rings true: paying cheap levies can lead to cheap outcomes, which often costs you more in the long run.

Naturally, exorbitant fees should be contested. However, when confronted with lower-than-average levies, you should consider whether you’re willing to not only compromise the value of your property but the safety and quality of life you and your loved ones deserve.

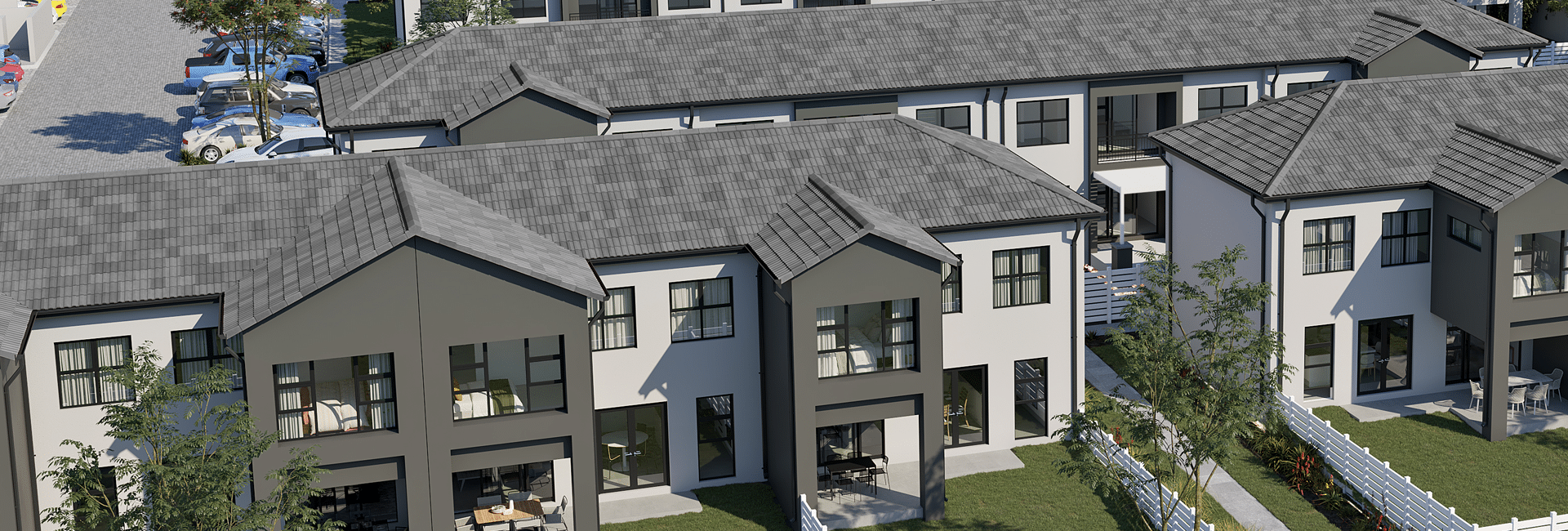

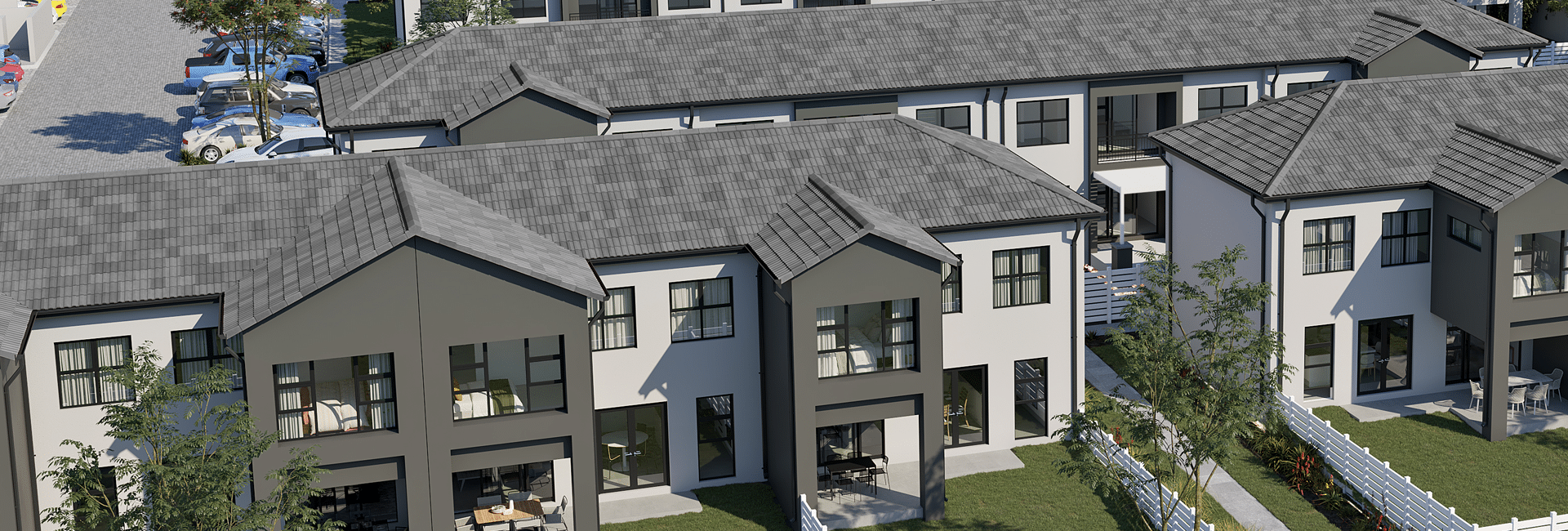

Levies are an essential element of having a well-maintained and managed Sectional Title Estate that fundamentally adds value to a buyer’s property investment.

Levies cover all expenses involved in the running of the estate, including security, maintaining common property, major long-term maintenance (for instance, repainting or repaving), insurance premiums, auditors’ fees, rates, taxes, municipal bills such as water and refuse removal, as well as the managing agent’s fees.

An accurate calculation of levies is key to an efficiently managed and valuable property, thereby guaranteeing satisfied homeowners. While high levies can cause skepticism in investors, cheap levies should be a red flag that overpromising and underdelivering is a possibility.

A constructive exercise to judge the value you derive from your levy is to calculate the cost of living in a comparable freestanding property, where you would be required to foot the entire bill. You’ll soon discover that both the time and money required to manage the property accumulate all too quickly and that your seemingly “expensive” levy is, in fact, quite reasonable. Similarly, such calculations can serve as alarm bells to levies that are too low which, ironically, may cost you more in the long term.

While there is merit in questioning whether you’re getting value for money when dealing with Sectional Title levies, the old adage of “Goedkoop is duurkoop” certainly rings true: paying cheap levies can lead to cheap outcomes, which often costs you more in the long run.

Naturally, exorbitant fees should be contested. However, when confronted with lower-than-average levies, you should consider whether you’re willing to not only compromise the value of your property but the safety and quality of life you and your loved ones deserve.

Levies are an essential element of having a well-maintained and managed Sectional Title Estate that fundamentally adds value to a buyer’s property investment.

Levies cover all expenses involved in the running of the estate, including security, maintaining common property, major long-term maintenance (for instance, repainting or repaving), insurance premiums, auditors’ fees, rates, taxes, municipal bills such as water and refuse removal, as well as the managing agent’s fees.

An accurate calculation of levies is key to an efficiently managed and valuable property, thereby guaranteeing satisfied homeowners. While high levies can cause skepticism in investors, cheap levies should be a red flag that overpromising and underdelivering is a possibility.

A constructive exercise to judge the value you derive from your levy is to calculate the cost of living in a comparable freestanding property, where you would be required to foot the entire bill. You’ll soon discover that both the time and money required to manage the property accumulate all too quickly and that your seemingly “expensive” levy is, in fact, quite reasonable. Similarly, such calculations can serve as alarm bells to levies that are too low which, ironically, may cost you more in the long term.

When this transpires, a perpetual cycle often ensues: additional funds are required for repairs and maintenance as the condition of the estate deteriorates further, the bills pile up and so it continues…

The Body Corporate simply will not be able to deliver what was promised to owners as there are just not enough funds to do so.

The value of your property will subsequently depreciate, especially in older estates and complexes where maintenance is critical. Armed with this knowledge, the ‘bargain’ of exceptionally low levies may no longer appear quite as appealing as you once thought.

When this transpires, a perpetual cycle often ensues: additional funds are required for repairs and maintenance as the condition of the estate deteriorates further, the bills pile up and so it continues…

The Body Corporate simply will not be able to deliver what was promised to owners as there are just not enough funds to do so.

The value of your property will subsequently depreciate, especially in older estates and complexes where maintenance is critical. Armed with this knowledge, the ‘bargain’ of exceptionally low levies may no longer appear quite as appealing as you once thought.

Newsfeed

Newsfeed

Chat to one of our sales executives and let us guide you on your property journey.

Summercon Office Park

47 Sunset Avenue Lonehill,

Johannesburg

Complete the form below and we will respond in a timely manner.

Chat to one of our sales executives and let us guide you on your property journey.

Summercon Office Park

47 Sunset Avenue Lonehill,

Johannesburg

Complete the form below and we will respond in a timely manner.

All rights reserved. Summercon 2025.

All rights reserved. Summercon 2025.